Placing a Price on Shopper Data

-The Future of Retail Real Estate Valuation-

By Karen E. Fluharty, Strategy+Style Marketing Group Founding Partner, Chief Strategist and Self-Proclaimed Data Doctor

VALUE RETAIL NEWS NOVEMBER/DECEMBER 2019

Whether working to estimate transactional value when selling a retail real estate asset, or seeking to increase its annual net operating income (NOI), the key to enhancing the investment may be right at your fingertips.

First-party shopper data.

Shopper data, including customer names, email addresses, home addresses, mobile phone numbers, etc., is often overlooked as a lucrative resource available to shopping center developers, ownership entities and investors. Alongside sophisticated advances in digital technologies that capture additional customer intelligence such as shopping patterns, preferred media delivery choice and online behavior, shopper data enhances the value of a property whether it is open and operating or on the market for sale.

Creating New Revenue Streams and Increasing NOI

In today’s quickly evolving and highly-competitive retail landscape, C-Suite executives are finding themselves facing greater demand to not only increase asset value, but to also prove the impact of marketing strategies on the bottom line. Justifying technology solution start-up and maintenance costs, as well as customer acquisition tactics – both organic and paid – is paramount to maintaining a competitive edge.

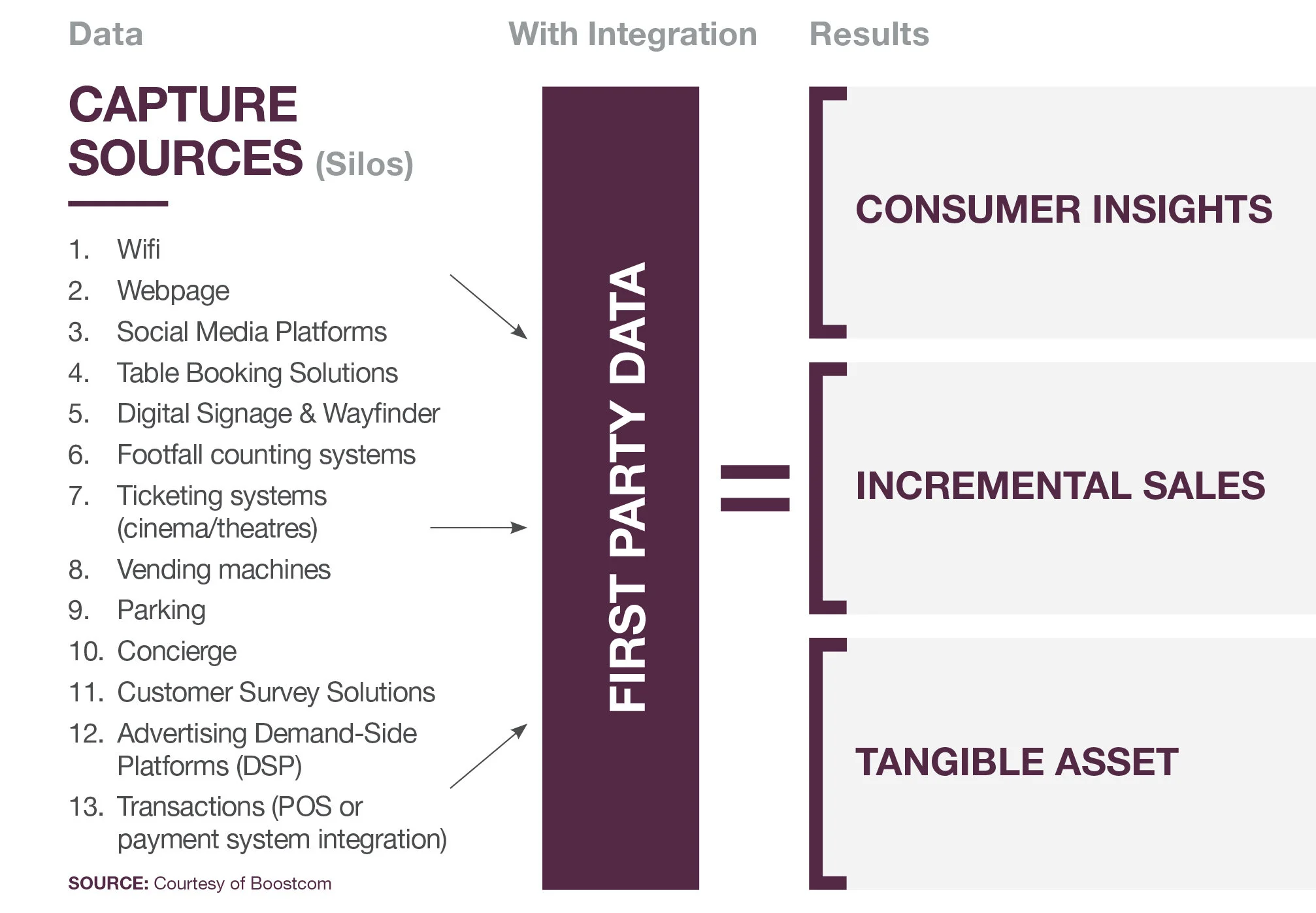

New digital marketing technology solutions and providers, which effectively connect on- and offline experiences to drive foot traffic and increase sales at brick-and mortar retail locations, are emerging at the forefront of the next frontier in retail real estate. Sophisticated data collection tactics that go beyond culling customer names and email addresses – such as Wifi gating, geofencing, mobile device location tracking, offline attribution and more – are proving to be methods that create more robust data profiles (think loyal and frequent shoppers), a more in-depth understanding of a shopping center’s true trade area, and better insight into opportunities to acquire new customers. By connecting the online customer journey to the physical world, the retail real estate industry can now deliver data driven, personalized messaging to loyal and potential shoppers, in the end creating asset value through incremental traffic and sales.

Armed with its well-established, multi-million member shopper database, Simon’s recent launch of its new Shop Premium Outlets online sales platform serves as a prime example of a developer leveraging its first-party data beyond traditional marketing activity in today’s digital marketing climate.

“Without the customer data, there would be no online platform,” said President and Founder of SQUEAKY.com Anthony Del Monte, developer of Premium Outlets’ VIP Club. “Simon’s successful build of a database comprised of more than six million VIP customers over time served as the pivotal piece in pioneering its e-commerce outlet shopping site.”

We see data valuation in other sectors, such as the entertainment industry, where customer information served as a significant revenue-generating element. For instance, Caesar’s Entertainment Operating Corp. recently argued its Total Rewards customer loyalty program data was worth $1 million, making the data itself, according to The Wall Street Journal, “the most valuable asset in [their] bitter bankruptcy feud.”

Today’s opportunities are plentiful and lie in a thoughtful “customer first” approach. Specifically:

• Asset value

• Selling to third-party users (including tenants)

• Marketing

Data’s Lucrative Transactional Value

In recent years, as retail real estate assets continue to change hands across the country, we’ve seen those looking to sell somewhat hesitant to include their first-party customer data as part of the overall transaction. In many cases developers are staunchly defending their ownership of customer data. Why is that?

Perhaps the answer lies in a void in understanding, let alone defining on paper, what data is worth. Or, is it C-Suite executives and marketers beginning to realize its potential?

According to Kristian Nordtømme, Chief Commercial Officer of Boostcom, a world leading proptech company serving the global shopping center industry, “When it comes to data being a part of a real estate transaction, our organization has insights into deals where the database itself has been treated as a separate asset with its own valuation.”

In the very near future, experts believe selling a retail real estate asset may serve as the strongest catalyst for data valuation. In order to do so, C-Suite executives must build within their senior management teams, or outsource to industry experts, a team dedicated to understanding data, its applications and its value. This will not only drive more effective annual marketing strategies going forward, but the opportunity to monetize it.

The Future of Data: Use and Valuation

With carefully curated tenant mixes, destination-making abilities and early efforts in traditional customer data capture, the retail real estate sector has certainly carved a unique and successful niche. However, that niche no longer provides enough of an edge since the advent of value-centric centers, mixed-used developments and master planned communities where consumers not only shop but also live, work, stay and play.

As an industry collective, we have diligently worked to not only develop new projects and reimagine existing ones, but also build large and engaged consumer audiences. However, this is only the beginning. Now it’s not only the dirt that has value. It’s the first-party audience profiles we own, coupled with the use of state-of-the-art data communication tools, that are allowing the retail industry to target, reach and engage time-strapped consumers like never before. However, the effective use and analysis of consumer data still remains untapped in its inherent potential to deliver value to the bottom line.

While transactional value activity tied to first-party data is already happening in Europe, its practice remains closely held in terms of the numbers. However, one can argue that stronger privacy regulations associated with the recent implementation of the General Data Protection Regulation (GDPR) has greatly benefitted the E.U. in the sense that consumers that do opt-in were required to make a conscious choice to do so. For the U.S. retail industry, we have the opportunity to create this demand to opt-in by better incentivizing shoppers through personalized, relevant and valuable calls to action. Via an in depth understanding of the data, shopping centers can now create more compelling experiences for shoppers which will result in improved community engagement, enhanced traffic and sales, and ultimately the creation of a higher asset value.

Conclusion

As the retail real estate landscape continues its rapid change -- including remerchandising and re-imagination strategies along with the increase of assets and entire portfolios changing hands -- C-Suite executives must invest in the capture, use and growth of first-party shopper data, viewing the data as a value creation opportunity. Just as site selection, favorable demographics and second-to-none tenant mixes are seen as pivotal for ongoing, successful operations and/or increased asset value, first-party data must be seen as strategic.

What exactly is shopper data worth? While a best practice formula, algorithm or equation that places a precise price on customer data does not yet exist, retail real estate experts collectively agree that data -- in itself an asset when leveraged -- can be worth millions of unrealized dollars, no matter the scenario.